28

Sep

World demand for beef to remain stable

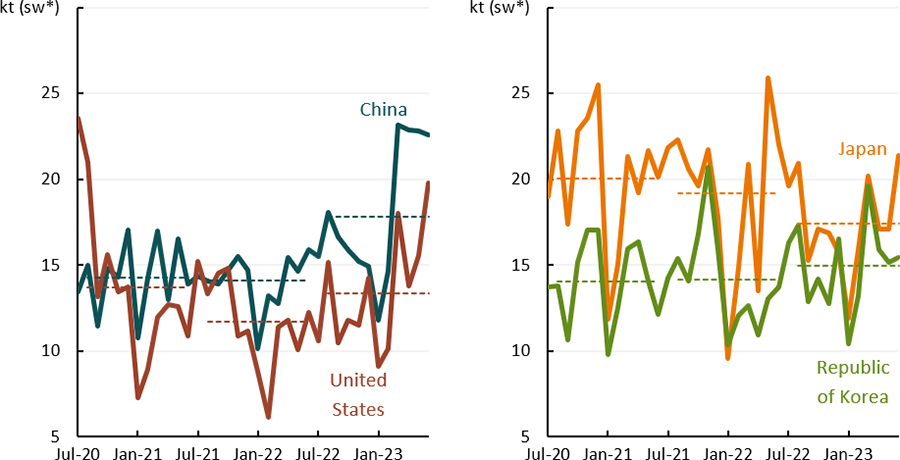

World demand for Australian beef is expected to remain relatively stable in 2023–24 as increased demand from China and the United States is offset by reduced demand in Japan and the Republic of Korea:

- China’s demand for Australian beef is expected to improve over 2023–24 following the relaxation of pandemic restrictions midway through 2022–23. Australian beef exports to China have been relatively strong recently despite China’s economic recovery losing momentum in recent months. Australia’s beef export volumes to China in March, April and May 2023 were the largest since May 2020 (Figure 1.5). Chinese beef importers appear to be becoming more price sensitive due to the challenging economic conditions; falling Australian beef export prices in 2023–24 expected to support strong Chinese demand.

- United States demand for Australian beef is also expected to rise slightly as US herd destocking continues, increasing US import demand. Australian beef exports to the United States have risen sharply over recent months (Figure 1.5); driven in part by a widening price gap between US and Australian lean grinding beef.

- Japan’s demand for Australian beef is expected decline slightly in 2023–24. Australian beef export volumes to Japan were relatively weak throughout 2022–23 and this is expected to continue into 2023–24 (Figure 1.5) with weaker household consumption. Japan’s cold store beef inventory has also steadily increased to record levels. Japan’s cold stores of imported beef are up to 30% higher year-on-year. This is expected to weigh on Japanese demand and limit inventory space for Australian beef exports.

- The Republic of Korea’s demand for Australian beef is expected to fall slightly in 2023–24. The country’s cattle herd is near historic highs. This herd is beginning a destocking phase, increasing beef production, and placing downward pressure on demand for Australian beef exports. Economic growth in the Republic of Korea has been below trend in 2023, weighing on consumer spending on products including beef. A survey conducted by the Korea Rural Economic Institute in January 2023 suggested imported beef consumption fell in 2022 in large part due to high beef prices.

Figure 1.5 Monthly volume of Australian beef and veal exports by destination

Source: ABARES; ABS

Rogelio Pérez

0 comment