UK Beef market update: trade stable but exports remain in annual decline

Key points

- UK beef imports remained relatively steady at 18,350 tonnes for September

- Import volumes for the year-to-date (Jan-Sep) have fallen by 7,000 tonnes from the same period last year

- GB steer prices continue to trade at a notable premium to Irish steers

- Export volumes have remained subdued compared to 2022, limited by strong GB prices and lacklustre European demand

Beef import volumes in September remained close to the previous months level, up by 250 t to 18,350 t. This brings the total for Jan-Sep 2023 to just under 165,000 t. This is a drop of 7,000 t (-4%) from the same period last year, with volumes particularly subdued in the first quarter of 2023.

Irish imports hold steady

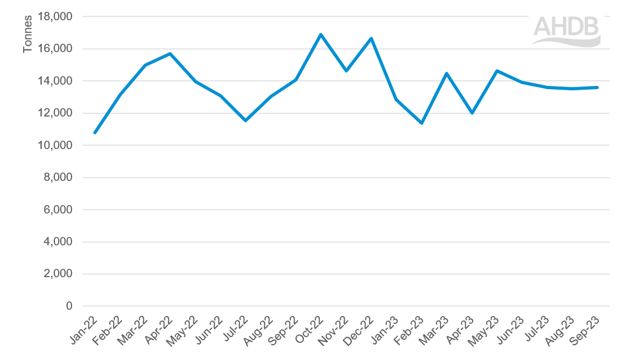

Volumes from our largest supplier – Ireland – totalled 13,600t for September, up marginally from August but down 3% against September last year. Volumes from Ireland have largely stabilised over the past three months. The price differential between GB and Irish steer prices continued to widen through September and October, but has since come back marginally. The gap stood at almost 89p for the week ending 06 November as Irish prices have risen in recent weeks. If this price differential continues at similar levels, this could keep imports of Irish product supported in the run up to Christmas to meet seasonal consumer demand.

Indeed, weekly Irish cattle slaughter has increased at pace since September to exceed 40,000 head in early November, slightly above last year’s levels. More recent market reports suggest that demand for cattle is firm as buyers secure Christmas supply, with the latest week’s quotes ticking up to reflect this. Going forward, youngstock figures point to some tightness in supplies next year.

UK monthly fresh/frozen beef imports from Ireland

Source: HMRC via Trade Data Monitor LLC

Exports stable but remain subdued

Export volumes have held relatively steady but have remained in decline against 2022, as has been the trend for most of this year. Volumes for September totalled 8,250 t, which represented marginal growth from August, but a fall of 1,150 t (-12%) from September 2022. GB cattle prices remain at an elevated premium over EU prices, limiting competitiveness in this market. Similarly, the EU market has been affected by lower demand for beef, which looks set to continue as per the European Commission’s latest forecasts (1% fall in consumption for 2024).

The market share of UK exports to the EU has fallen from last year, when looking at the year to date (Jan – Sep). In 2022, the EU imported 72,500 t of fresh/frozen beef from the UK, with a market share of 36%. For the same period in 2023, these volumes have fallen to 51,300 t with a market share of 28%. Volumes exported to Japan have fallen in the year to date, by 1,650 t to 900 t, as falling demand for beef continues to weaken imports.