UK beef and lamb trade update: exports supported by tighter EU market, while sheep meats imports remain firm

The most recent beef and lamb trade data has been released by HMRC for November 2023, we explore the detail.

Key points

- Imports of sheep meat from Australasia remained high in November 2023

- Sheep meat exports to Europe rose with competitive UK prices in comparison to key European markets

- Beef trade volumes rose in November, with continued growth in exports to Europe

Sheep meat imports from Australia remain elevated in November 2023

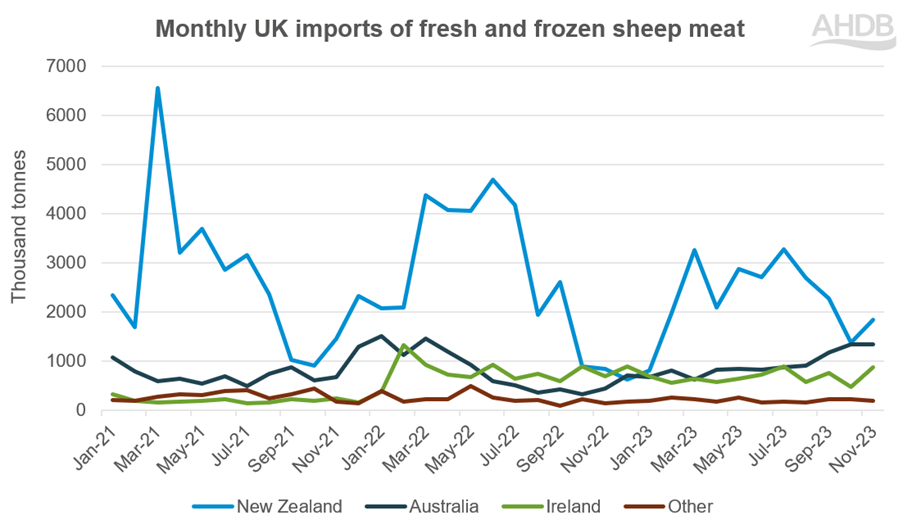

UK fresh and frozen sheep meat imports for November totalled 4,241 tonnes, an increase of 801 tonnes (+23%) compared to the previous month. In comparison to November 2022, import volumes practically doubled – up by 2,100 tonnes – the greatest increase seen so far in 2023.

Increased volumes of sheep meat from New Zealand and Australia have made up a large proportion of this growth.

In October 2023 the UK imported the highest volumes of sheep meat from Australia since March 2022, totalling 1,349 tonnes. Volumes fell marginally in November, but levels remained high at 1,345 tonnes. This is over three times more than the amount imported during the same month the year before, albeit November 2022 figures were low (439 tonnes). Volumes have been continually rising as the TRQ between the UK and Australia has progressed, something which we continue to monitor closely.

In terms of imports from New Zealand, volumes have fallen since a peak in July. In November, volumes totalled 1,840 tonnes, which was just over double that seen in November 2022. However, for the year-to-date (Jan-Nov), total sheep meat imports from New Zealand have fallen by 6,623 tonnes (-21%) in 2023 against the previous year. But this does follow the long-term declining trend previously seen in sheep meat imports from New Zealand. Reduced UK demand and shifting trade patterns will have influenced these figures, with New Zealand directing more product into closer markets in 2023, such as China. With a reduction in volumes of imported New Zealand sheep meat to the UK, trends have not followed typical patterns in 2023 with a less defined spike in imports during the easter period compared to previous years. Imports levels remain historically low for 2023.

Source: HMRC, via Trade Data Monitor LLC

UK sheep prices remain competitive in comparison to European prices. For the week ending 13 January 2024 the GB deadweight OSL SQQ sat at 605.5p/kg, compared to the EU reference deadweight lamb price of 669.5p/kg. Sheep prices in Oceania remain competitive, however market reports suggest with increased demand from Australian processors, there is optimism regarding some strengthening of the Australian sheep market.

Exports of sheep meat also rose month on month into November by 7%, as well as 14% year on year totalling 8,021 tonnes. Shipments of UK sheep meat to the EU have increased month on month in November, with France taking the bulk of this product (4,547 tonnes). With reduced production rates on the continent and the continuance of UK prices running below those seen in France, the UK has maintained competitive edge, driving our exports.

This will be discussed further in our soon to be released lamb market outlook, exploring predictions for 2024.

Beef trade remains subdued

According to the most recent HMRC data, in November UK beef exports totalled 11,157 tonnes, the highest figures seen so far in 2023 – up 15% from October and up 10% compared to November 2022. The rise is due to increased European demand, as well as expected seasonal movements pre-Christmas.

Beef imports also rose by 2% month on month to a volume of 20,160 tonnes – 6% above figures seen for the same period in 2022. This is the third consecutive month where imports have risen, with November seeing the second highest import figure so far in 2023. Shipments from Ireland have continued to rise totalling 14,785 tonnes in November, likely supported by wide cattle price differentials at the time.

@ahdb