UK beef and lamb trade update: competitive imports support August volumes

The latest UK beef and lamb import and export data has been released by HMRC for the month of August. We explore the detail.

Key points

- August sheep meat import volumes higher vs 2022 for the first time this year, as Australian and New Zealand product remains extremely price competitive.

- UK beef trade lower in August, but imports of Irish beef supported by wide price differentials.

Imports of Australian lamb creep up

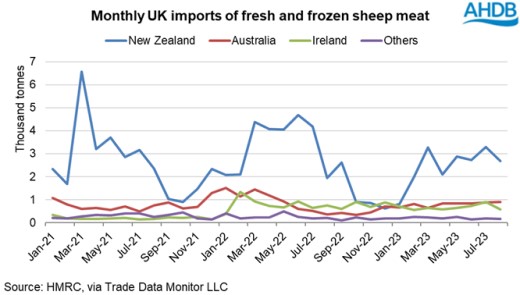

For the first time this year, monthly quantities of sheep meat imported into the UK were higher than levels recorded a year ago. The UK imported 4,300 tonnes of fresh and frozen sheep meat in August, substantially more compared to August 2022.

More product was imported from New Zealand and Australia compared to the same month a year ago. Generally, UK sheep meat imports have not followed typical trends in 2023. Typically import levels spike in March to fill the supply deficit around Easter, then subside in the summer as domestic supply increases, before picking up again towards Christmas. This year, while there was an uplift in imports in March, it was much less pronounced than in previous years. Furthermore, month-on-month, import levels have generally been on an upward trend since January.

Despite this trend, import levels had – until August – remained historically low. The last time August import volumes of Australian lamb were higher than this year was in 2014.

Sheep prices in Oceania are currently very competitive compared to Europe. Australia is producing and exporting record quantities of sheep meat, which has pressured their farmgate prices. Such is the sheer size of Australian output, this has also weighed on neighbouring New Zealand lamb values, despite lamb production there being closer to year-ago levels.

The domestic market has remained firm so far this year. Increased export and decreased import levels through the first half of the year have reduced supplies of lamb on the market and supported farmgate prices to hold at historically strong levels. However, growth in imports at a time of year where domestic production also grows has increased supplies recently. How import levels continue at current prices will be important to watch.

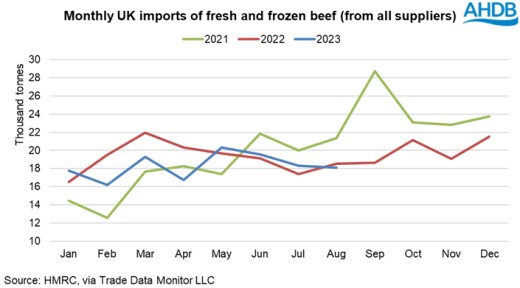

Beef trade generally subdued but Irish imports supported

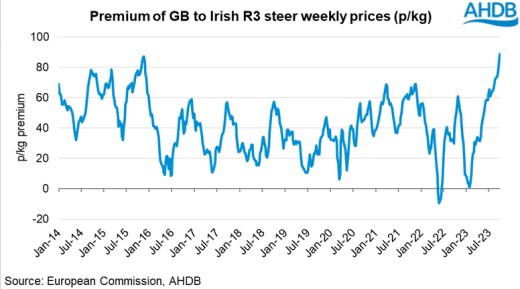

By contrast, UK beef imports have been closer to 2022 levels. Volumes were particularly low through the first quarter but held above last year’s levels through the summer, driven by an uptick in Irish shipments. At this point Irish beef prices were falling rapidly and growing in competitiveness, pressured particularly by weaker demand on the continent. The price differential of Irish and GB cattle remains particularly wide; Irish R3 steers were trading at close to 89p discount to GB steers in the week ending 2 October. The last time the price differential was recorded in this region was in November 2015.

UK prime cattle prices have generally regained their premium position in the European market this year. This, coupled with lower European demand, is likely contributing to lower UK export volumes. The UK has lost market share of EU beef imports so far this year. While total EU beef imports are down on the back of weaker demand, other third countries have shipped more, particularly Brazil and Argentina. Supplies there are particularly competitive now on the back of greater Brazilian production.