Sheep meat update: EU production falls as national prices vary

Key points

• EU sheep meat production falls as key producing country output drops

• EU prices vary through nation as Spain sees big seasonal growth

• GB prices remain supported above last year’s levels

How has production changed over the first half of 2023?

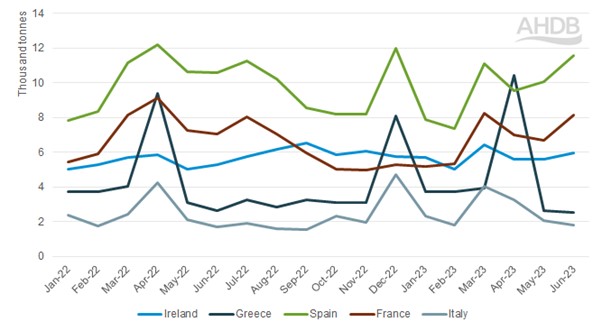

EU sheep meat production for the first half of 2023 has been varied throughout the top producing countries, as combinations of lower slaughter and lighter carcase weights limit output. Spain and France have seen falls in production from the same period the previous year of 5%. Greece, Ireland and Italy saw growth from 2022, up 2%, 7% and 5% respectively. Production from the top five producers totalled 175,000 Mt in H1 2023 (down 1.3% year-on-year), as sheep throughputs totalled 11.9m head.

Looking into the top five, Spain’s production reached 57,400 t in the first half of 2023, as slaughter stood at 4.5m head. Both factors, however, saw a fall of 5% from the same period in 2022. Production in France totalled 40,600 t and slaughter at 2.1m head, with production and slaughter both down on the year.

However, Greece, Ireland and Italy show more positive production figures. Greek production totalled nearly 27,000 t, with slaughter levels at 2.3m head for H1. Production grew by 400 tonnes from 2022, but throughputs fell by 6%, highlighting growth in carcase weights. The spike in production for April is a yearly trend, as Greek Easter is typically celebrated with consumption of lamb. Ireland’s production totalled 34,300 t with slaughter at 1.5m head. Sheep meat production in Italy reached 15,250 t, with growth of 660 t from the previous year. Similarly, slaughter grew by 129,000 head, as a higher kill rate drove production.

Monthly sheep meat production in select EU countries

Source: European Commission

Mixed movement in EU lamb prices

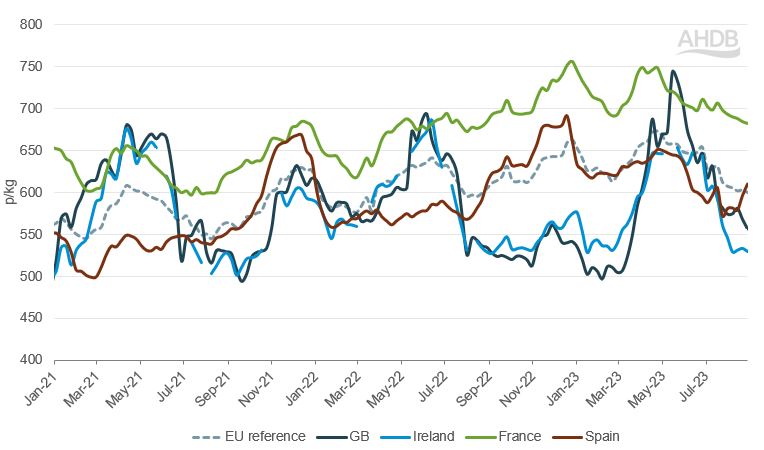

Looking into prices, the EU reference price has fallen seasonally since April, sitting at an equivalent of 615p/kg for the week beginning 4 September (latest date available). However, this is 3.5p ahead of its position during the same week a year ago having ticked up in recent weeks. Prices have generally been pressured by increasing supplies from non-EU markets such as New Zealand and the UK as well as weaker consumer demand. Looking into the market balance, the volumes available for consumption (imports + production – exports) have increased slightly compared to the first half of last year. Whilst production has dropped, imports have grown to cover the deficit and have increased the supplies available for consumption. This is despite industry reports showing that household lamb purchases are lower year-on-year in several key countries.

Prices in Spain have seen a seasonal resurgence recently, to average 635p in the week beginning 4 September. French prices have been mainly falling since mid-April, with the odd upward movement, with the average price for the week beginning 4 September at 685p, down 5p from the four weeks previous. French prices have only in recent weeks dipped below last year’s levels. However, they remain strong against the wider EU market.

Closer to home, Irish prices have also moved down seasonally, but have shown more stability in the last four weeks, averaging 529p in the week beginning 4 September. Industry reports of later lambing dates, lower scanning percentages and longer finishing times on farm continue to impact on lamb supplies.

Weekly EU and GB deadweight lamb prices

Source: European Commission, AHDB

What does this mean for the UK?

Lower EU production has been beneficial for UK export, which in turn has offered support to the UK market. As the UK is anticipated to move into a net exporter position, the EU market will grow in importance. Moving into the second half of 2023, the European Commission note that the price attractiveness of EU markets will drive imports from the UK and New Zealand. The presence of New Zealand within the EU market looms, as import volumes are up compared to last year, especially given the price disparities between EU and New Zealandprices in recent months. Similarly, New Zealand product into the UK for July grew by 350 t, as total imported volumes grew by 800 t.

GB prices continue to hover above last year, as we move further into the season. The deadweight SQQ for August sat at 569.5p/kg, a fall on the month of around 30p, but still above the previous year. Slaughter levels for August show slightly higher kill, up to 1m head (UK). This is growth of 108,000 head from July’s levels. The liveweight SQQ shows a similar pattern, at 259.4p/kg for August, a drop on the month with gains compared to last year. Average weekly throughputs in GB auction markets were higher in August compared to July, up around 12,000 head to just over 100,000 head for August.