Lift in export manufacturing beef prices as year gains momentum

THERE’S been a surge in imported manufacturing beef prices into the United States in what some market participants are interpreting as early signs of supply stress, due to the effects of the US beef herd sinking to 40-year lows due to drought.

In Aussie currency terms, imported 90CL frozen grinding beef in the US was last week quoted at 834.6c/kg CIF. That’s up 76c/kg or 10pc since the start of the year, and almost 100c/kg or 13pc higher than this time last year, when the US was still processing cattle at elevated levels due to drought.

Much of the current export manufacturing beef demand is stemming out of the US, where the national economy continues to function surprisingly strongly, and to a lesser extent, Asian customers like Japan and Korea. At the same time, demand out of China remains very flat, export trade sources said this morning.

There’s several main drivers behind the current lift in demand, and price, traders say:

The first is stock inventory levels. Chilled and frozen meat stocks worldwide (including Australia and the US) are now much lower than they were earlier. Many customers are quite current with stock on hand, arousing their appetites to secure supply.

“There’s just less meat in the system,” a large Australian exporter said this morning.

“There’s been weather related issues, and the US was around 220,000 head short of what it expected to kill for January. On top of that, Australia has had some slow weeks, so inventories everywhere are pretty tight.”

On the customer side, beef demand in the US, North Asia (except China) and domestically in Australia had been ‘OK’, the trader said.

“The US economy continues to surprise. Some have said quick service restaurant demand in North America hasn’t been great through February, but we’re not seeing that. Whether it’s QSR or retail, US demand for imported seems to be solid,” he said.

On the demand front, retail ground beef demand in the US will ramp-up in April and May as the northern hemisphere grilling season gets underway, while large end-users that rely on frozen imports for part of their production are likely to have a good portion of their needs covered.

Another factor, as prices for all beef rise in the US, has been that more US domestic cuts (example: shortplates) that previously were going into the grind now have greater value as whole primals. That’s lowering US output of grinding beef.

“When shortplates are cheap, they are often used as a raw material for grinding, but there’s nothing cheap in the US beef market now. That’s adding extra demand for imported lean trimmings,” the export trade contact said.

“One way or another, a lot of this price rise is being driven out of the US. We traded 90CL lean trimmings at US240/lb late last week, up 20c/lb in three or four weeks. Most of the fat and lean points have lifted US15-20c/lb since this time last month.”

What’s clearly evident is the large price gap that persists in the US beef market between imported and equivalent domestic product.

“That’s because there is a very different imported beef market environment now in the US than what Australia has faced, historically. There’s a lot more cheap Brazilian meat being used in the food service and manufacturing trade than there ever was before.

“A lot of end-users now have it in their grind formula. At the other end, there are end-users who now use only domestic fresh trim. We may not see imported and domestic trimmings lining up in value again – at least any time soon,” the trader said.

China flat

While there had been a small lift in demand out of China leading up to the Chinese New Year, that had not continued in more recent trade.

“It’s better than it was last year, but that’s not saying much. The Chinese economy isn’t helping,” the trade source said.

Domestic market

On the local front, demand for trimmings and manufacturing beef in the Australian market remained ‘pretty robust,’ another trader said.

“Generally, inventories are in much better shape than they were this time last year, when there was a lot of meat sloshing around the system, heading into Easter,” he said.

“Demand a year ago was quite flat, but it is better than expected this year. Consumers have been ‘looking for a recession that hasn’t eventuated’, and it’s kept demand higher than expected.”

Cold storage stocks held in Japan and South Korea are also much tidier than what they were earlier.

“Inventories are in better shape, and demand, in general, is OK – so product is moving as it comes in. That’s why we’re seeing trim prices going up – everyone is competing that little bit harder for it.”

While livestock prices on slaughter cows ran up since the start of January quicker than the recent lift in manufacturing beef prices, export processors are now making decent margins on slaughter cows, Beef Central was told. That’s despite prices being quoted last week in direct consignment offers in Queensland at 510c/kg carcase weight, having finished the 2023 year at 400c/kg.

Speculation over second quarter US production

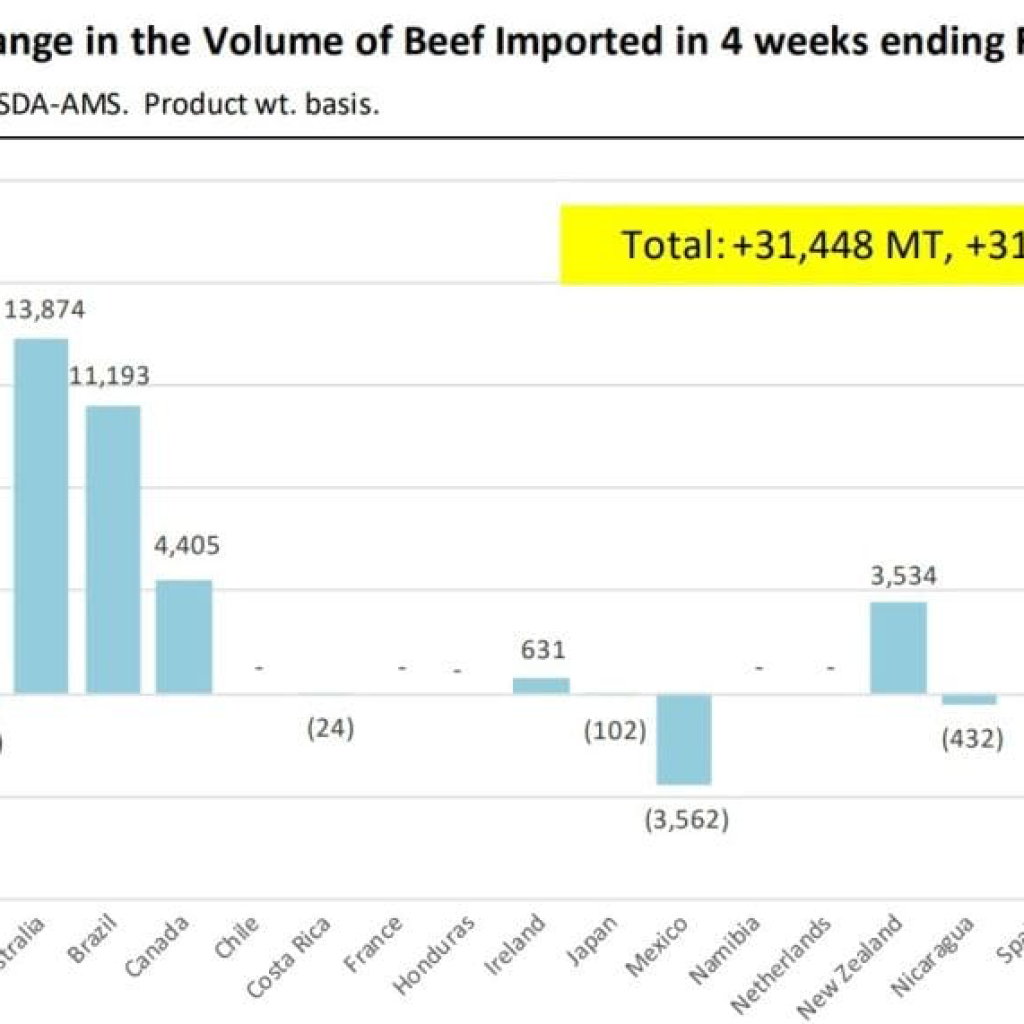

In his weekly imported beef market summary last week, US analyst Len Steiner published this graph, showing the year-on-year change in imported beef volume into the US for the four weeks to 10 February up 31pc, or 31,500t.

Source: Steiner.

That’s partly because of declining US weekly beef kills as drought impact on herd size starts to take hold. Last week’s US slaughter at 608,000 head was 17,000 head or 3pc lower than the already low slaughter this time last year.

Mr Steiner said much of the current US industry speculation revolved around domestic US cow slaughter levels in the second quarter (starting 1 April) and the potential for domestic lean values to change.

“Hard as that was to imagine just a couple of months ago, talk of 90CL lean grinding beef getting in the US330-340c/lb level is still out there, or at least the potential for reaching those levels,” Mr Steiner said.

“What seems to be less of concern, at least in the near term, is demand. The rapid increase in prices over the last four weeks was a reminder of how quickly this market can rally when buyers get caught short.”

He also noted that US chicken prices are moving higher at a faster pace than some expected for this time of year.

In an earlier daily livestock report, Mr Steiner noted changes in USDA’s monthly updates to its red meat and poultry supply/demand forecasts.

“For a while the USDA forecast/assumption was that imports would post only a modest increase in 2024. Now USDA thinks that US beef imports in 2024 will be almost 400 million pounds (+10.7pc) higher than in 2023,” he said.

“And if the forecast ends up being correct, it implies 1.1 billion more pounds of imported beef (+35pc) than in 2019.”

“It is no secret that Australia has been shipping more beef here and that’s expected to continue,” Mr Steiner said. “Imports from New Zealand are also expected to continue. As for South American beef, it is largely capped by quota, although more out of quota beef may be available should US lean beef prices climb over $300/cwt.”