EU beef market update: Lower demand weighs on prices, despite lower production

Beef production in the EU has remained below 2022 levels during the first half of the year. Despite tighter supplies, cattle prices have generally eased, reflecting subdued summer beef demand.

Key points

- Beef production back across the EU for the first half of 2023

- Lower supplies available for consumption (production + imports – exports) compared to 2022

- Consumer data indicates a softening demand picture, playing a key role in the adjusting EU marketplace

Constrained kill reduces beef production

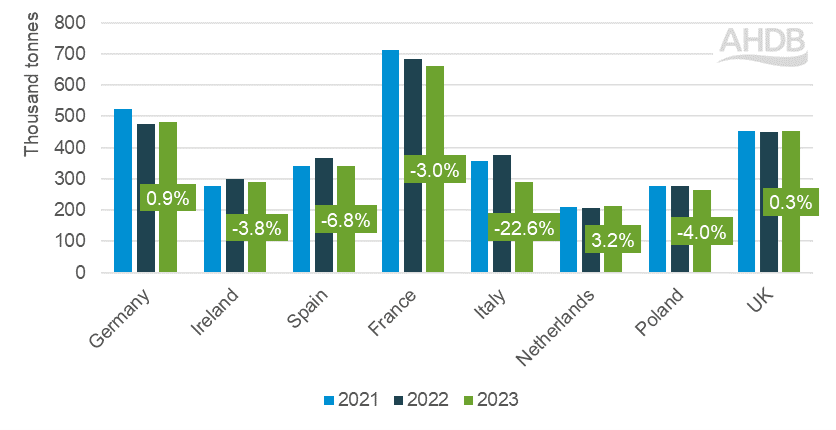

Production of beef in the EU during the first half of 2023 was 4.5% lower than the same period a year ago, with cattle kill constrained amongst key producing nations.

Looking at member states, the largest production fall was seen in Italy (-23%), followed by key producers France, Spain, Ireland and Poland. The only main producers to see growth were Germany and the Netherlands. However, for Germany, this growth sits against the general longer-term trend of declining output.

Beef production in the top EU producing countries, Jan–Jun of each year (plus UK)

Source: Eurostat, Defra

Overall, total adult cattle slaughter in the bloc (steers, bulls, heifers and cows) stood at 8.1 million head, down 3.6% versus the same period a year ago. Within this, total cow kill stood at just under 3 million head, down 3.7% year-on-year.

Several countries have seen notable declines in cow slaughter, namely France, Poland and Spain. French cow production is currently running at its lowest level in at least the last five years and likely contributing to the continued strength of French prices on the EU market. Polish kill is also historically low. Conversely, Spanish cow slaughter has grown in recent years and, while lower than last year’s record levels, remains historically high so far in 2023. German cow slaughter has stayed relatively stable year-on-year, following several years of declines.

Meanwhile, Dutch cow kill has grown quite strongly from last year (+13%) and is running at similar levels to 2021.

Rising costs weigh on consumption

From a market balance perspective, taking into account decreases in production and trade shows that supplies available for consumption are lower across the bloc. Price inflation is impacting beef consumption across the EU as it is in the UK, with consumption and retail data from key EU nations pointing to falling demand.

FranceAgriMer report that French home consumption of beef through the first half of 2023 fell by 2.5% year-on-year, as average prices increased by 9.1%. Analysts AMI report that German household beef purchases were 6.2% lower year-on-year from January to July (inclusive), as the average price rose by 6.9%. German meat consumption has been falling for some time, but significant price increases are likely exacerbating this trend currently. Italian beef purchases fell by 4% year-on-year during the first half of 2023, to levels also below the previous two years (ISMEA Mercati). Meanwhile, MAPA report that Spanish beef consumption is also in decline.

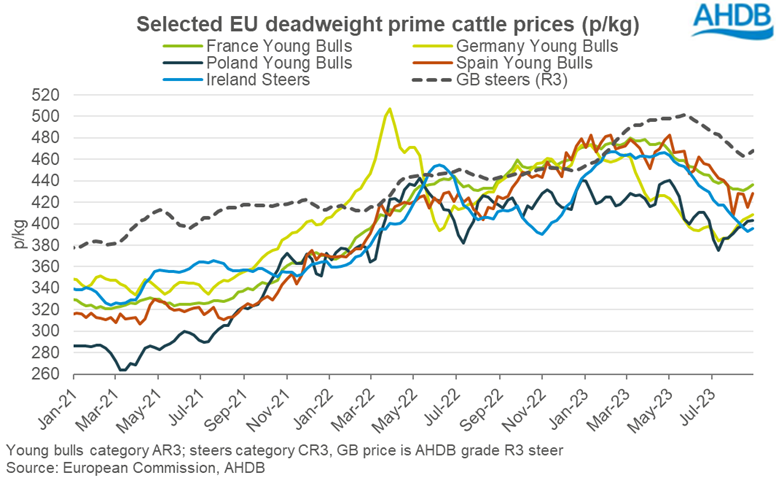

Mixed movement in cattle prices

EU cattle prices have generally been on a downward trajectory since March. However, in recent weeks, prices for cattle in certain countries has shown upward movement. Young bull and cow prices in Ireland, France, Germany and Poland have ticked up, while young bull values have also risen in Spain. Elsewhere, cattle prices have continued to be more subdued, such as in the Netherlands and Italy.