CAB Insider: Carcass Weights to Plunge, Quality to Remain

Abbreviated slaughter schedules have been prevalent because of last week’s weather burdening packers with power outages and transportation issues. Following two reduced weekly head counts, due to holidays, last week’s estimated 549,000 head total was 17% smaller than the same week a year ago. This week also started below recent normal weekday head counts with just 112,000 head harvested compared to the more typical 125,000 head range.

Although last week’s $173.80/cwt. fed steer price was down $0.70/cwt., the market found decent support as packer needs to fill the supply chain were offset by cattle being pushed back in the harvest schedule.

Live Cattle futures prices have been mounting a comeback in seesaw fashion since the first of the year. The February contract has gained $3.50/cwt. since January 2, but the setbacks have been as frequent as progress.

Boxed beef are reflecting the recent smaller production volume with the Choice cutout up 2% or $5.83/cwt. this Monday versus last Monday. The CAB cutout shows a decline of $2.75/cwt. in the week-to-week average. Yet the decrease follows a week when the CAB price advanced while the Choice cutout trended lower, generating an abnormally wide CAB-Choice price spread of $26.31/cwt. Last week’s opposite relationship between the two was a trailing realignment

On average across several years, January through the first week of February is typically a lower beef demand period when prices move generally sideways. It’s a time when high-flying middle meat values deflate from December and end meats strengthen a bit as the cheaper roasting items come into focus. Logically, spot market cutout prices may remain more elevated in light of recent supply struggles.

In December, the brand recorded the second largest pounds of CAB product sold by packers to licensed partners.

Carcass Weights to Plunge, Quality to Remain

The onset of severe cold temperatures and snow accumulation in a broad spectrum of cattle feeding regions will pull fed cattle production down. Beyond the reduced weekly slaughter head counts, carcass weights are set to plunge. Since the all-time record high carcass weights were recently recorded in late December, there is certainly some flex in the production system as far as boxed pounds of product per head.

From a cattle feeder’s perspective that conversation is void since feed efficiency and daily gains have been slashed dramatically the past ten days. Pen conditions will erode in the future as temperatures warm up, adding to cattle performance declines.

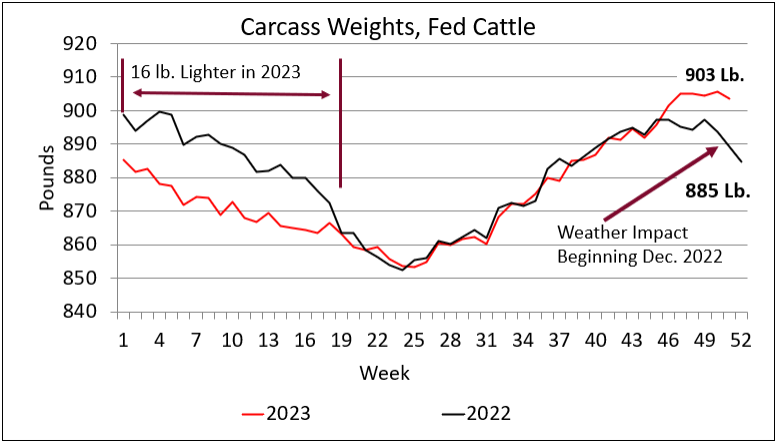

The chart details fed cattle carcass weights for the past two years. The 2023 weight trend started with the first four months trailing 2022 by an average of 16 lb. per carcass. That winter’s storms and brutal temperatures are still fresh in our minds with the duration of poor conditions measured in months, not weeks. Although this season’s weather impact is not yet two weeks underway, a similar pattern in decreased cattle performance will come through in the carcass weight data very soon. Formula steer weights were down 5 lb. Monday, January 15, as the weather shift was initially developing. That was the the tip of the iceburg.

Shifting focus from carcass weight to carcass quality the outlook remains positive through the first quarter. We’ve detailed previously in the Insider that extreme cold temperatures haven’t historically had a negative impact on marbling scores. In fact, the trend is just the opposite as improved national average carcass quality, in terms of percent USDA Choice and Prime and percent CAB acceptance, is often noted during these weather conditions.

Increased potential carcass quality is one of the only benefits of a polar vortex event for cattle feeders. Feedyards may see more of their Angus-type cattle qualifying for the Certified Angus Beef ® brand than would have been achieved under conditions favoring heavier carcass weights.

Since marbling scores below Modest 00 (the minimum requirement for Premium Choice) are the primary reason carcasses are not certified for the brand, marbling improvement is key to capturing more CAB carcasses and premiums. But lighter average carcass weights (primarily in big steers) pull the percentage of carcasses exceeding the brand’s 1,100 lb. maximum lower than otherwise might have been realized in ideal feeding performance conditions, increasing the pen’s percent CAB acceptance.

Lighter weights also mean fewer ribeyes exceeding the brand’s traditional 16 square inch maximum and those measuring more than the one square inch upper limit.

@drovers.com