Australian red meat exports surge amid global demands

Key points:

- Red meat exports rose 36% in February from year-ago levels to 150,118 tonnes.

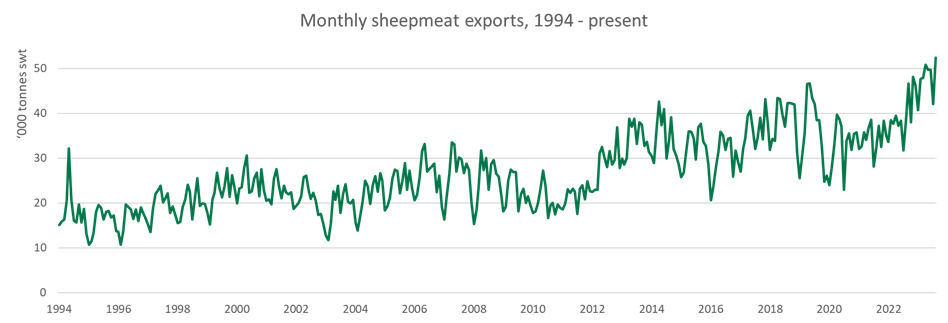

- Sheepmeat exports hit an all-time monthly high, at 52,351 tonnes.

- Japan was the largest beef market for the first time since February 2023.

Australian red meat production continues its upward trajectory, leading to a surge in export volumes to unprecedented levels. With robust demand in key export markets and a global shift in supply, Australian exporters are well positioned to capitalise on increased production and address shortages from other suppliers.

Lamb and mutton

In February, combined lamb and mutton exports reached 52,351 shipped weight tonnes (swt), marking the highest export volume for any month on record. Lamb exports have been very high over the past few years, but what makes this figure remarkable is that February is usually a month with relatively smaller export volumes. Beyond being the shortest month, export volumes usually peak in the last three months of the year, as the spring flush yields increased production.

Source: DAFF, MLA

In 2024, high slaughter volumes at the start of the year translated into very strong export volumes. The United States remained Australia’s largest lamb market, with exports rising 36% year-on-year (YoY) to 7,543 swt. Meanwhile, exports to China lifted 15% YoY to 5,215 swt. Mutton exports overall lifted 37% YoY to 21,299 swt. China remained the largest market for mutton exports, amounting to 6,639 swt, while exports to Saudi Arabia experience the most significant growth among major markets, growing by 161% YoY to 1,796 swt.

Beef

Beef exports lifted 33% YoY to 93,834 swt, nearing the levels exported in February 2019 and marking the fourth-largest February export total on record. Exports to Japan lifted 43% YoY to 23,794 swt, becoming the largest market for the first time since February 2023, while exports to the USA rose 83% YoY to 21,341 swt and exports to China lifted 26% YoY to 15,757 swt.

The lift in exports to Japan is promising, coinciding with the clearance of the meat backlog in cold storage. Compared to 2023, beef in cold storage in Japan has fallen by 14%, while in the United States cold stores have fallen by 12%, due to demand amid declining production. As such, the rise in exports to Japan is a promising signal that demand for Australian beef is robust in global markets, and that the increase in supply forecast in the recent cattle projections will be in high demand around the world.

Goat

The United States emerged as the largest export market for goat in February, with exports lifting 143% YoY to 2,149 swt, 55% of total exported volume. Export volumes lifted in all major export markets except China. Volumes to South Korea increased by 52% YoY to 690 swt, volumes to Trinidad and Tobago lifted 176% to 275 tonnes and exports to Taiwan grew 366% to 179 tonnes.

@MLA