ANALYSIS: China’s Beef Imports Hit Lowest in April Since Start of 2024 Amid Sluggish Demand

China’s April 2024 beef imports plummeted to its lowest point since the start of the year, shedding 7.7% month over month or 18,718 mt to 224,402 mt, the latest General Administration of Customs People’s Republic of China data indicated.

By virtue of its population, China is the world’s second largest beef market after the US, with most of the growth led by affluent urbanites. In recent years, the beef market has been further boosted by the rapid growth of the ‘quick commerce’ sector, which offer express meat deliveries.

Frozen boneless beef took up the bulk of the Chinese volumes, with imports jumping 22.9% or 41,856 mt on a yearly basis.

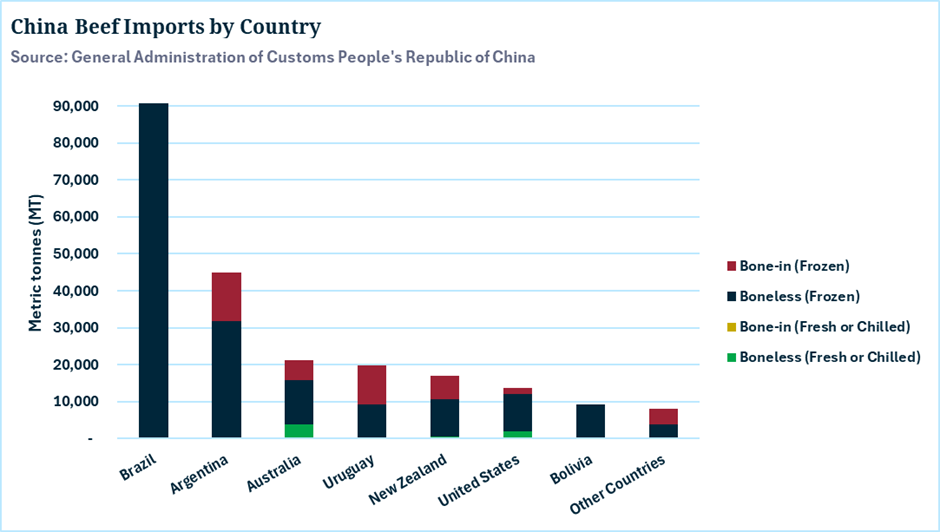

Driven the government’s initiative to diversify its meat supply, more than 30 beef exporting countries are now granted market access. South American countries still dominate China’s direct frozen beef import market, particularly Brazil, Argentina, and Uruguay, which have benefited from weaker currencies and competitive prices. In April 2024, imports from these key South American markets formed close to 70% of China’s total imports.

Imports from Brazil earned its top spot as its long-preferred supplier, taking up 40.5% of the market share. China imported 90,826 mt of boneless beef from Brazil, a drop of 6.2% or 6,016 mt compared to the previous month. On a yearly basis, volumes soared 70.2% or 37,457 mt as imports restrictions were lifted this year. Exports to China was suspended in 2023 over Bovine Spongiform Encephalopathy (BSE) issues.

Argentina came in second at 44,853 mt, plunging 18.6% m-o-m or 10,233 mt. Volumes conversely grew 15.5% or 6,013 mt on a yearly basis. Imports from Argentina formed 20.0% of Chinese April’s imports.

Australia ranked third with a market share of 9.5%, dipping by 3.5% m-o-m or 778 mt at 21,210 mt. On a yearly basis, imports rose by 12.3% or 2,331 mt as production grew.

Uruguay took the fourth spot capturing a market share of 8.8%, equivalent to 19,754 mt. Imports shed17.8% or 4,285 mt on a m-o-m basis. Volumes fell 19.8% or 4,889 compared to March 2023.

New Zealand came in fifth, with volumes recorded at 16,885 mt. Imports fell 7.4% m-o-m or 1,345 mt, taking just 7.5% of the market share. Known for its production of leaner grass-fed beef, volumes reduced by 14.3% or 2,810 mt y-o-y as exports to the higher netback US market took preference.

The United States ranked…